The Most Modern & Proven Pricing Technology in Lending

Lender Price is the first cloud-native, AI-driven pricing engine trusted by the nation’s largest bank, credit union, wholesale lender, and mortgage servicer. Built on a modern technology stack, our solutions offer lenders of all sizes a configurable pricing platform that is scalable, user-friendly, and easy to integrate, resulting in improved workflows and greater pricing efficiencies.

Rapidly Execute Profitable Lending Strategies with Ease

Trusted by some of the largest financial institutions in the industry, we provide clients of all sizes with products and solutions that help them increase volume, benefit from workflow efficiencies, and improve their market competitiveness.

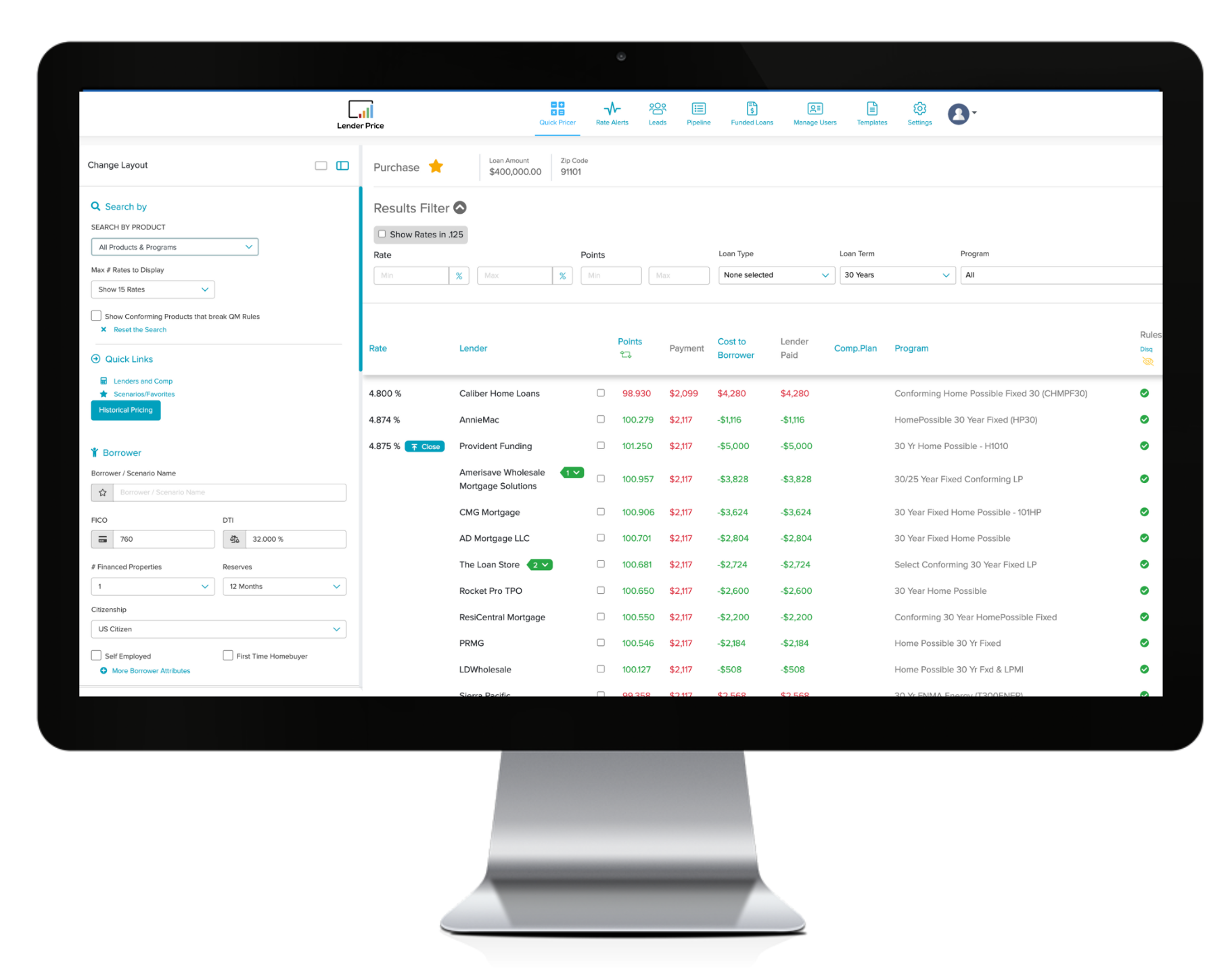

PRODUCT & PRICING for BANKS, LENDERS & CREDIT UNIONS

Our Enterprise Pricing Engine is an all-in-one PPE for every channel that comes standard with innovative features such as granular margin management, LLPAs and eligibility rules, multi-dimensional rules management tools, pipeline monitoring capabilities, lock desk automation, custom notification rules, compliance checks, and more.

MARKETPLACE for BROKERS, LENDERS & AGENTS

Broker Marketplace is one of the largest broker-lender communities in the industry, helping mortgage brokers find the best rates and loan programs for their borrowers.

Lender Marketplace enables lenders to reach thousands of wholesale brokers quickly and raise awareness of all loan programs.

CAPITAL MARKETS AUTOMATION

Lender Price provides full capital markets support with cutting-edge automation that is designed to help optimize pricing strategies and streamline operations. With Base Price Solution, capital markets and secondary teams are able to automate pricing with full transparency for regulators and auditors, helping them get pricing out faster when the market changes.

PRODUCT & PRICING for NON-QM & NON-AGENCY

FLEX by Lender Price is a customizable pricing engine designed to help non-QM and non-agency lenders offer niche loan products with confidence. Lenders can create their own pricing search tool quickly without the complexity and cost of development. With FLEX, lenders are able to market products and pricing quickly and conveniently online.

NEXT-GEN RECAPTURE SOLUTION FOR LENDERS & SERVICERS

Lender Price’s APR gives mortgage lenders and servicers the power to instantly evaluate loan scenarios for refinancing and home equity. By leveraging real-time market data, automation, and personalized borrower offers, APR helps grow portfolios, increase loan origination, and enhance customer retention efficiently and at scale.

ARTIFICIAL INTELLIGENCE

Lender Price uses AI, machine learning, and data-driven insights to help lenders and loan officers make smarter decisions and drive growth. AILA (AI Loan Assistant) provides loan officers with real-time eligibility and compliance guidance to close loans faster and more accurately. With AILA Builder, lenders can create natural-language pricing rules and custom UIs all without writing a single line of code.

Proven Platform Stability

$300B+

Locked Loan Volume

400+

Customers (Partners)

130K+

Loan Products

Serving All Channels

We cover all business channels, including sub-channels (retail, distributed retail, direct to consumer, wholesale, correspondent, delegated, NDC and bulk).

RETAIL

We provide banks, lenders, and credit unions with the ability to support non-QM, non-agency, and portfolio loans with fast and accurate automated underwriting.

WHOLESALE

CORRESPONDENT

Gain deeper client-level management over margins, EDP/EPO waivers, product eligibility rules, LLPA’s, lock maintenance, and loan updates.

LENDER PRICE WINS 2024 ICE LENDERS’ CHOICE AWARD FOR INNOVATIVE SERVICE PROVIDER

“Having a solution that’s configurable and flexible end to end is something that’s unique because every lender operates differently.”

Dawar Alimi

CEO, Lender Price

What Sets Us Apart

Lender Price harnesses the power of artificial intelligence and cloud-native technology to transform lending operations from the ground up. Our advanced platform automates complex pricing strategies, delivering real-time data analysis and predictive insights that empower lenders to make faster, smarter decisions.

We built the very first cloud-native solution that has the ability to automatically scale vertically and horizontally according to demand, which allows for the greatest flexibility, operational efficiency and performance, empowering lenders with the tools they need to succeed in today’s competitive market.

With granular rules creation using natural language processing (NLP), microservices architecture to ensure pricing stability with zero downtime, endless configurable workflow policies with advanced pricing functionalities, and tailored post-lock processes, we offer a truly comprehensive solution that is unmatched by our competitors.

Start A Conversation

Our expertise can get you up and running quickly for maximum success. For pricing solutions and services you can trust, contact us today!

Join our newsletter

Get the latest industry news and updates on our products.